change in net working capital calculation

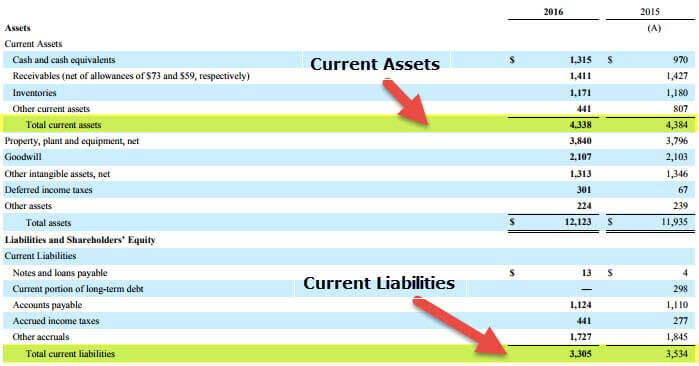

The shorter the working capital cycle the faster the company can free up its cash stuck in working capital. Net working capital is a liquidity calculation that measures a companys ability to pay off its current liabilities with current assets.

Change In Working Capital Video Tutorial W Excel Download

So if a producer holds the full working interest in the production unit.

. Its a measure. The Working Capital Cycle formula may vary depending on different types of business. Therefore a business tries to shorten the working capital cycles to improve the short-term liquidity condition.

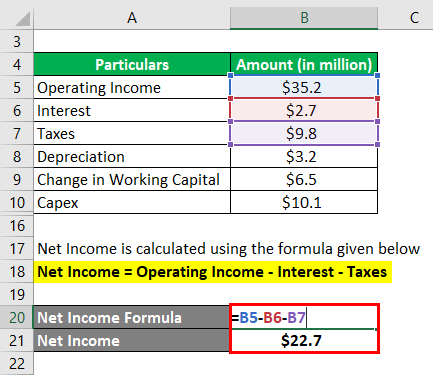

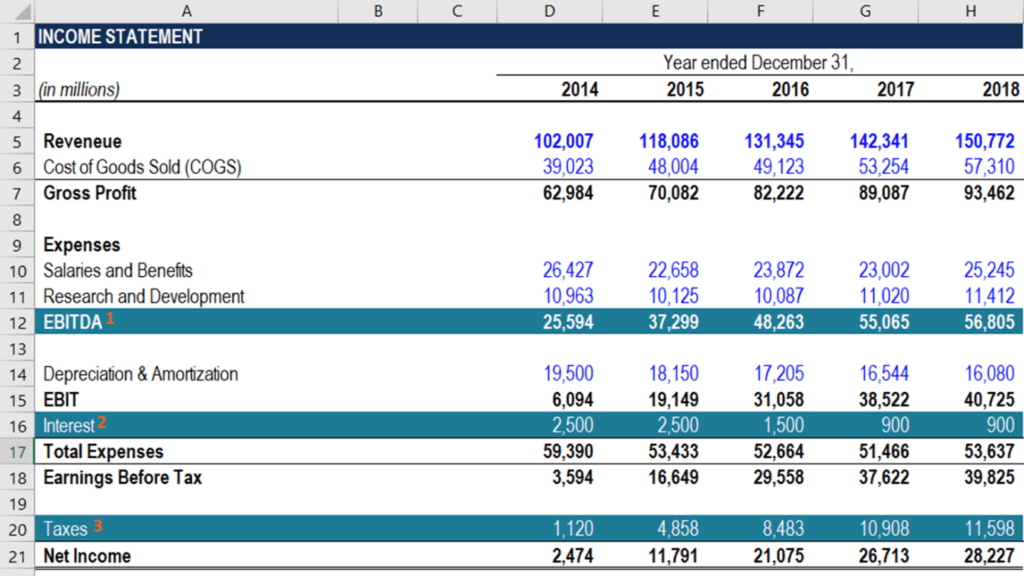

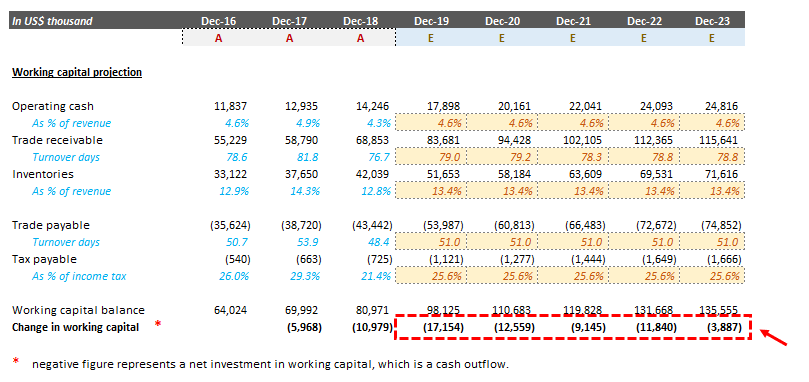

200m annual climate-related opex. Next well calculate the invested capital which represents the net operating assets used to generate cash flow. So if the change in net working capital is positive it means that the company has purchased more current assets in the current period and that purchase is basically outflow of the cash.

If you are not very familiar with the summation notation the extended form of the IRR formula may be easier to understand. Our best estimate of capital spend on mitigation to 2030 of which 15bn in 2022-2024. 75t CO 2 e internal carbon price.

To get net revenue interest for each entity that owns a share of working interest divide their working interest by 82. Securities and Exchange Commission SEC in 1975 to regulate directly the ability of broker-dealers to meet their financial obligations to customers and other creditors. What is Working Capital.

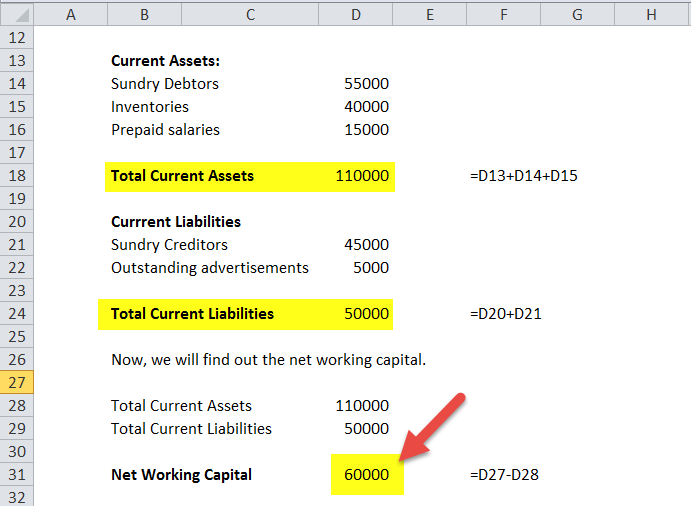

For example a manufacturing business will have more phases than a retailer. Changes in Net Working Capital Working Capital Current Year Working Capital Previous Year Or. Broker-dealers are companies that trade securities for customers ie brokers and for their own accounts ie dealers.

Working capital is a measure of both a companys efficiency and its short-term financial health. Annual financial statements interim financial information and other financial information required by sections 1212 1213 and 1214 of National Instrument 31-103 Registration Requirements Exemptions and Ongoing Registrant Obligations NI 31-103. Spreadsheet includes examples calculations and the full articleIts taken a lot of thought over many years to fully understand this idea of what the.

The formula to calculate the Working Capital Cycle for this. So a positive change in net working capital is cash outflow. Up to 3bn growth capital in materials enabling the energy transition.

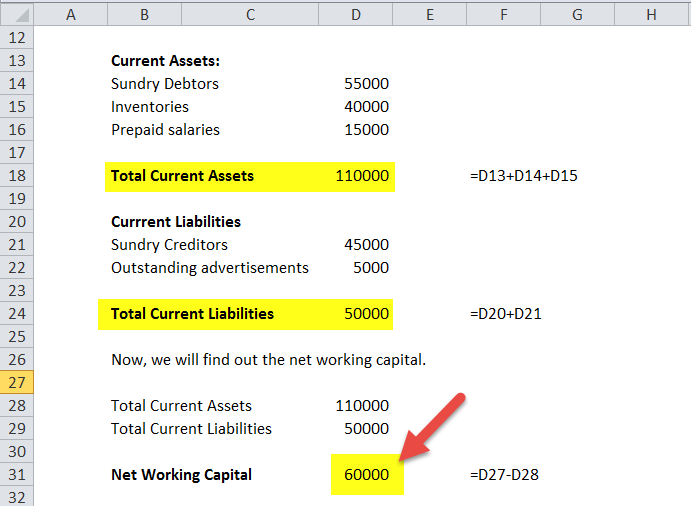

Expected to reduce as energy efficiency work matures. Working capital is calculated as. Change in a Net Working Capital Change in Current Assets Current Assets Current assets refer to those short-term assets which can be efficiently utilized for business operations sold for immediate cash or liquidated within a year.

IRR calculation in Excel. Lets calculate the Working Capital Cycle for a fictitious manufacturing company. The working capital ratio also called the current ratio is a liquidity ratio that measures a firms ability to pay off its current liabilities with current assets.

For the working capital schedule and fixed assets forecast the following assumptions will be used. If the price per unit of the product is 1000 and the cost per unit in inventory is 600 then the companys working capital will increase by 400 for every unit sold because either cash or accounts receivable will. Too long working capital cycle blocks the capital in the operational cycle.

Current liabilities are best paid with current assets like cash cash equivalents and. This capital does not even fetch any return. Financial Leverage Formula Degree Of Financial Leverage Formula The degree of financial leverage formula computes the change in net income caused by a change in the company.

This measurement is important to management vendors and general creditors because it shows the firms short-term liquidity as well as managements ability to use its assets efficiently. In 2023 and 2024. As a general rule the more current assets a company has on its balance sheet in relation to its current liabilities the lower its liquidity risk and the better off itll be.

Today is the day the dust on the topic of changes in working capital finally settlesRead this page slowly and download the worksheet to take with you because the whole topic of changes in working capital is very confusing. It comprises inventory cash. Calculation of Nestles total debt in 2015 and 2014 is as follows.

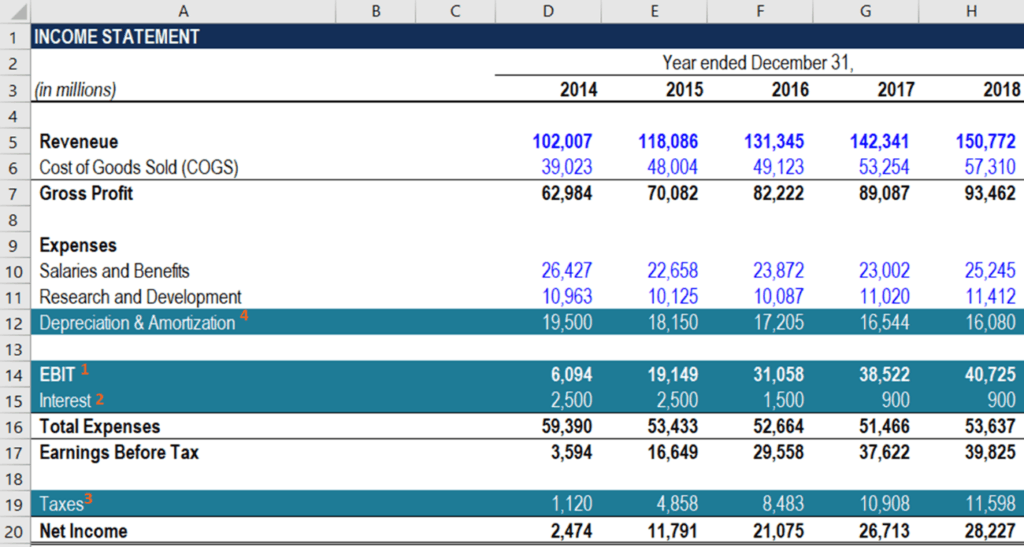

75bn capital in carbon abatement projects. Example calculation with the working capital formula A company can increase its working capital by selling more of its products. The bank determines that during the 2015 tax year the business had an average number of 30 employees and that for the same tax year the businesss gross receipts were 3000000 and its assets consisted entirely of inventory and working capital.

Form 31-103F1 Calculation of Excess Working Capital. Examples of Working Capital Cycle. The working capital ratio is important to creditors because it shows the liquidity of the company.

More Cash Flow Definition. Working capital or net working capital NWC is a measure of a companys liquidity operational efficiency and short-term financial health. Similarly change in net working capital helps us to understand the cash flow position of the company.

As the internal rate of return is the discount rate at which the net present value of a given series of cash flows is equal to zero the IRR calculation is based on the traditional NPV formula. The uniform net capital rule is a rule created by the US. A retail clothing business submits an application for a loan from a community bank on February 1 2016.

Notice to the regulator of a repayment of a subordinated loan or. How to Calculate Net Working Capital NWC The net working capital metric is a measure of liquidity that helps determine whether a company can pay off its current liabilities with its current assets on hand. Working capital is the amount available to a company for day-to-day expenses.

Net Working Capital Assumptions.

Changes In Net Working Capital All You Need To Know

Cash Flow Formula How To Calculate Cash Flow With Examples

Net Working Capital Definition Formula How To Calculate

How To Calculate Fcfe From Ebit Overview Formula Example

Net Working Capital Formula Calculator Excel Template

How To Calculate Fcfe From Ebitda Overview Formula Example

Change In Working Capital Video Tutorial W Excel Download

Change In Net Working Capital Nwc Formula And Calculator Excel Template

Net Working Capital Definition Formula How To Calculate

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Working Capital Formula And Calculation Example Excel Template

Net Working Capital Meaning Examples Formula Importance Change Impact

Change In Working Capital Video Tutorial W Excel Download

Change In Working Capital Video Tutorial W Excel Download

Change In Net Working Capital Nwc Formula And Calculator Excel Template

Net Working Capital Formula Calculator Excel Template

Change In Net Working Capital Nwc Formula And Calculator Excel Template